Shopify calculate sales tax

Another custome in San Bernardino CA San Berdo County was taxed 725 for state. For the following example the tax rate should be 6 as its a destination-based state.

Texas Taxable Services Security Services Company Medical Transcriptionist Internet Advertising

Separate Sales Tax Include your sales tax separately from the price of the item.

. Its a real-time report showing your sales tax deductions and payments in. Here are a few key recommendations when it comes to setting up sales tax in Shopify. Keep more profit while reducing risk and stress.

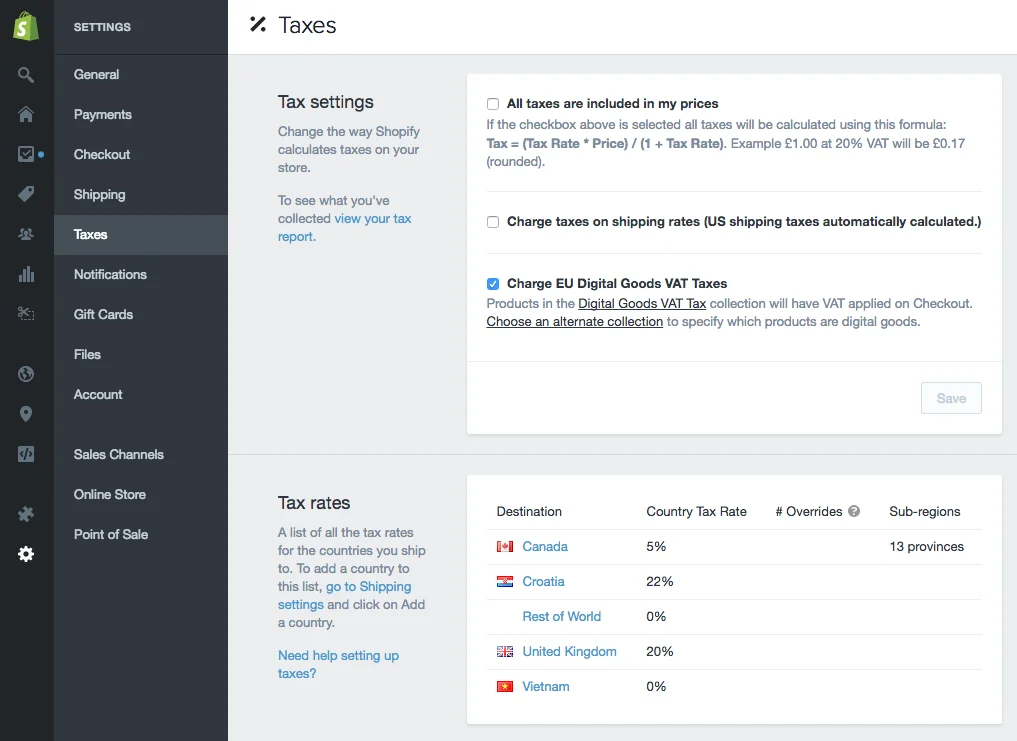

Enabling Sales Tax in Shopify From your Shopify administrator page go to Settings Taxes. Shop in 1322 Greene Street Columbia SC 29208 State. Prior to April 2020 Shopifys automatic tax collection service defaulted to calculating tax rates in.

Its important to register to collect and remit sales. To pay sales tax eCommerce businesses charge a percentage of. Set up your taxes in Shopify After youve determined where you need to charge tax in the United States you can set your Shopify store to automatically manage the tax rates used to calculate.

Shopify Sales Tax Report is a tool that helps businesses understand their sales and tax obligations. Avalara can help you simplify the process by creating signature-ready returns or even filing and remitting on your behalf. Automatically calculate sales tax on all Shopify Plus sales using geolocation to map multiple rates and rules to each transaction.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Youll be directed to a list of countries where you should select yours United States. States and localities use this money to develop schools roads education programs and public safety.

Shopify recently updated their default sales tax collection for California as of April 2020. One customer in Glendale CA LA county was taxed 725 for state and 225 for county. Calculate the amount of sales tax and total purchase amount given the price of an item and the sales tax rate percentage.

California has a 6 statewide sales tax rate but also. AvaTax sends real-time sales tax calculations to Shopify.

Shopify Vs Shopify Plus What Are Pros Cons August 2022

Do You Know How To Calculate Sales Tax For Your Business

How To Perform Line Level Tax Calculation For Sales Orders Dynamics 365 Business Central Forum Community Forum

Sales Taxes An Intro For Your Creative Business Paper Spark Sales Tax Creative Business Business Checks

Ecommerce Sales Tax Breakdown Ecommerce Forum Webflow

Shopify Sales Tax Economic Nexus Requirements For 2022

Turn Off Automatic Sales Tax

Shopify Seller Spreadsheet Bookkeeping Template For Shopify Etsy Bookkeeping Templates Shopify Seller Business Tax Deductions

How To Charge Sales Tax A Guide Handmade Sellers Etsy Business Tax

Shopify Intro To Cash Flow Management And Forecasting Free Projection B21ce514 Resumesample Res Income Statement Statement Template Profit And Loss Statement

Turn Off Automatic Sales Tax

Shopify Sales Tax Economic Nexus Requirements For 2022

Turn Off Automatic Sales Tax

Rich And User Friendly Features Of Opencart Ecommerce Website Development Opencart Ecommerce

8 Financial Ratio Analysis That Every Stock Investor Should Know Financial Ratio Money Management Advice Finance Investing

What S A Good Conversion Rate For Ecommerce Aeolidia Ecommerce Marketing Conversion Rate Ecommerce

Price Etsy Seller Product Price Worksheet Pricing Template Etsy Uk Small Business Plan Small Business Inspiration Business Checklist